Introduction

The insurance market is the sector of the economy responsible for managing policy negotiations, protecting individuals, companies and beneficiaries from unforeseen financial losses. It is made up of some types of companies such as insurance companies, brokers, insurtechs, among others. Insurance is a contract that determines that one of the parties — called the insurer — undertakes, upon receipt of a payment — the premium —, to indemnify the other party — called the insured — in relation to losses provided for in the agreement. Let’s look at some important definitions used in this marke:

Premiums: The premium is the amount you pay to be entitled to the insurance coverage you have contracted. To be entitled to compensation, it is necessary to pay a specific amount, defined at the time of contracting. This payment is the prize. The amount of the insurance premium depends on some factors. Some of them are the type of insurance, the coverage offered by the policy and the risk profile of the insured.

Claim: In the insurance market, a claim refers to any event in which the insured property suffers an accident or material damage. It represents the materialization of risk, causing financial losses for the insurer. Having a claim means that a situation or damage covered by your insurance occurred. As such, you must take action so that your insurer can begin the entire process of repairing the damage or providing the compensation due.

Goal

The objective of this study is to create a statistical model that can estimate the claim (ocurred claim) of the 775 insurance sector in Brazil based on information from previous dates.

Sector 775 is known as Guarantee Insurance for the Public Sector. This insurance contract guarantees the faithful fulfillment of the obligations assumed by the policyholder towards the insured, in accordance with the terms of the policy and up to the value of the guarantee established therein, and in accordance with the modality(s) and/or coverage(s) additional(s) expressly contracted, due to participation in bidding, in a main contract pertinent to works, services, including advertising, purchases, concessions and permissions within the scope of the Powers of the Union, States, the Federal District and the Municipalities.

Data Base

The database used is from the SUSEP Statistics System (Private Insurance Superintendence). SUSEP is a federal agency linked to the Ministry of Economy in Brazil responsible for controlling and supervising the insurance, open private pension, capitalization and reinsurance markets.

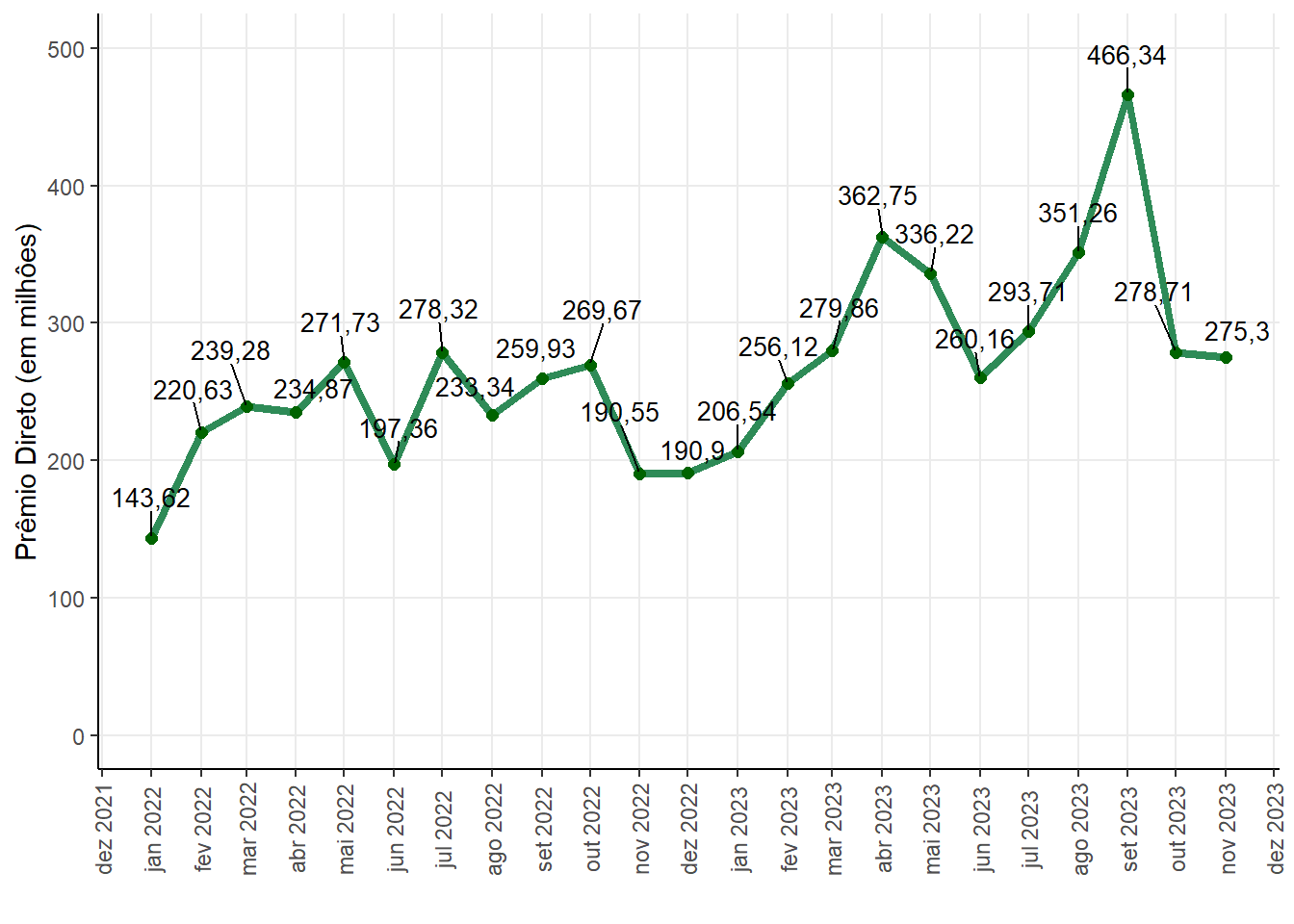

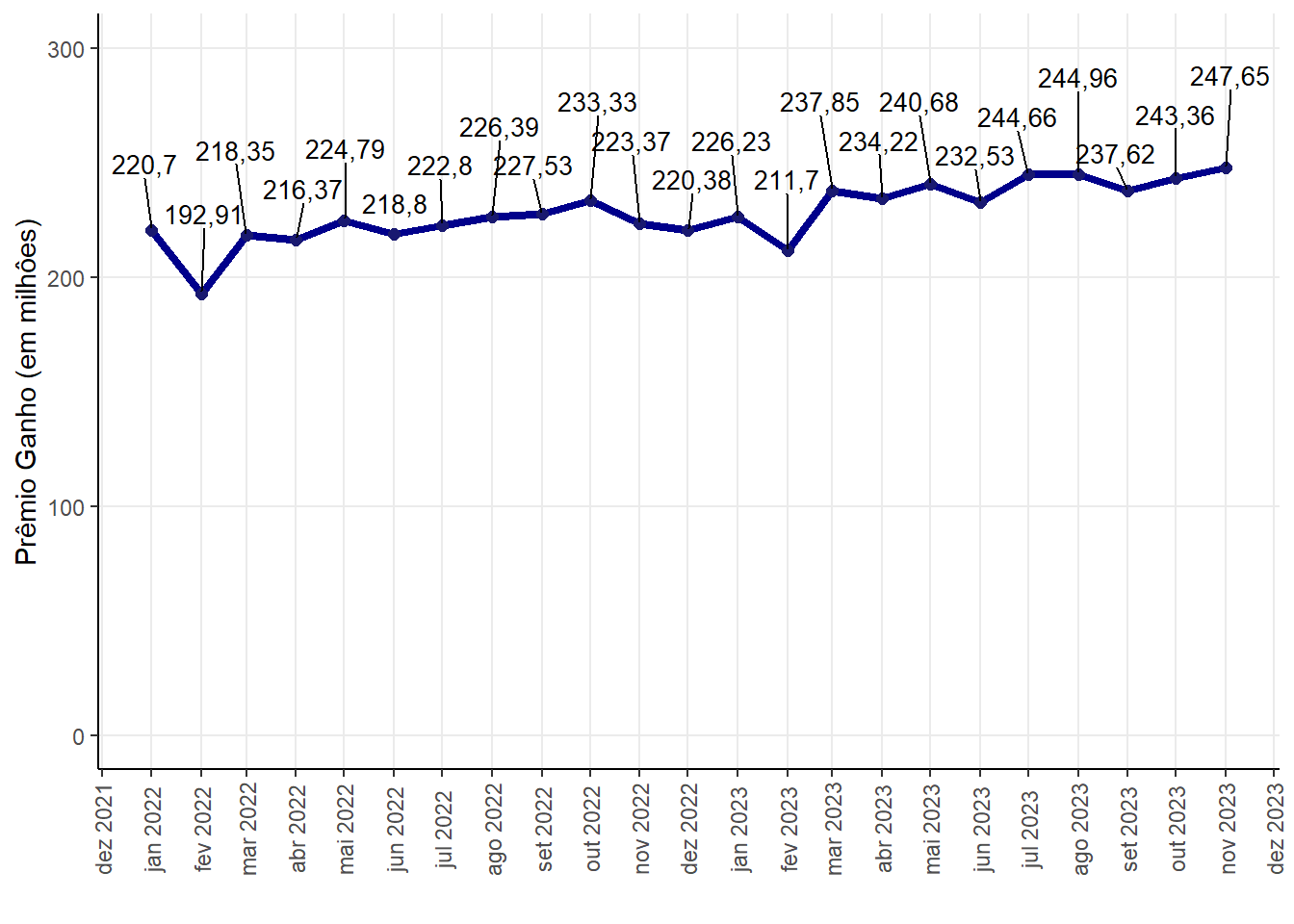

The selected operation was Premiums and Claims grouped by sector, from January 2022 to November 2023, in order to analyze the premiums and claims of sector 775 - Guarantee for the Public Sector.

Dataset can be accessed at https://www2.susep.gov.br/menuestatistica/SES/principal.aspx.

Results

In this topic we will see a little about the behavior of our variable of interest: “Claim”. We will analyze how it behaves in relation to the other variables that will be used to estimate our model and, in addition, we will see the development of the model.

Descriptive Analysis of each variable

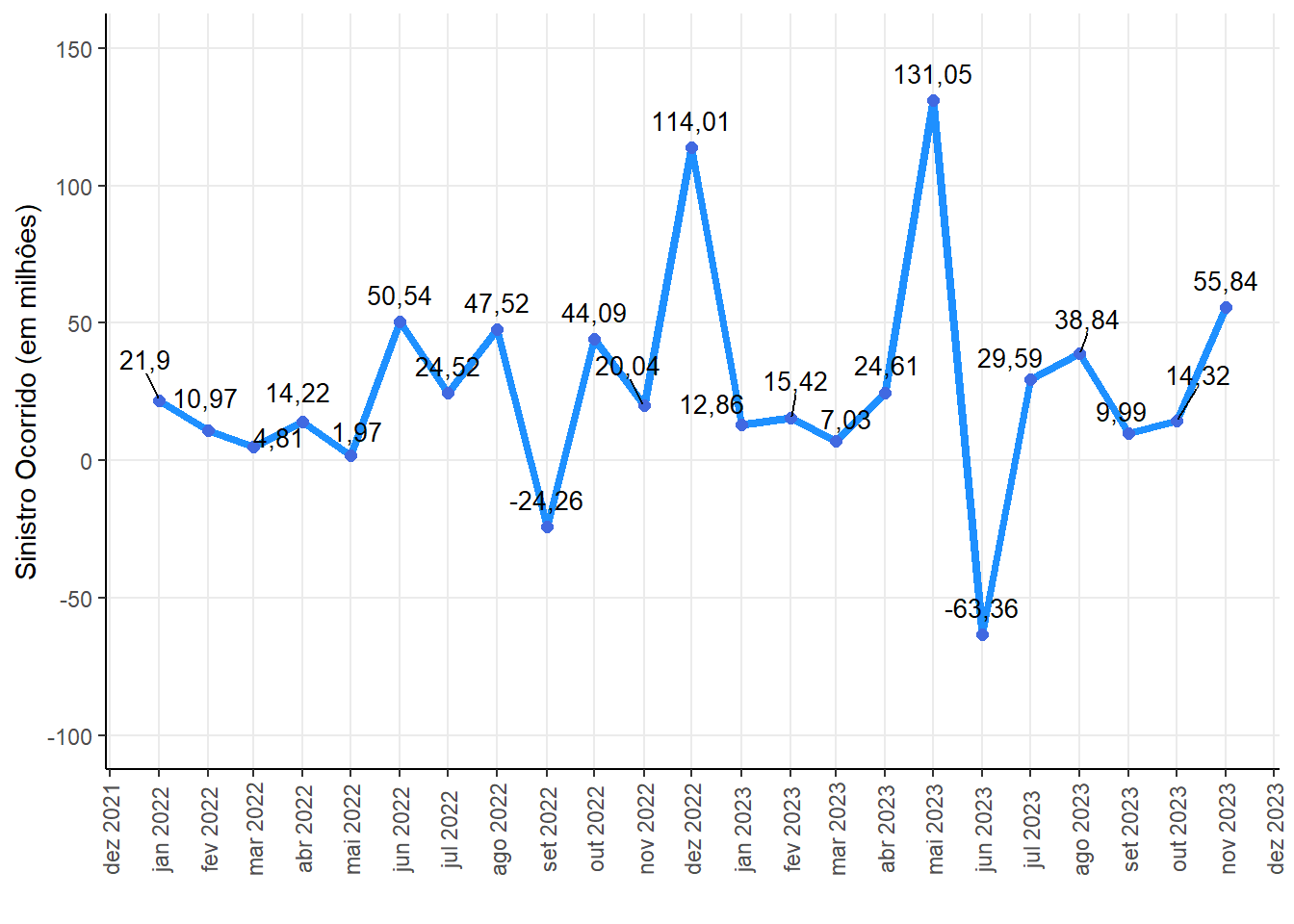

Historical series of the claim ocurred for the sector 775 - Insured Guarantee - Public Sector

An accident occurs refers to the occurrence of an event that causes damage or damage to an insured asset. For an event to be considered a claim, coverage for the event that occurred must have been contracted and be present in the policy during its validity.

Therefore, having a claim means that a situation or damage covered by your insurance occurred. As such, you must take action so that your insurer can begin the entire process of repairing the damage or compensating you.

Ocurred Claim (in million)

|

||||

|---|---|---|---|---|

| Min. | Median | Mean | Max. | Std Dev |

| -63,36 | 20,04 | 26,37 | 131,05 | 39,45 |

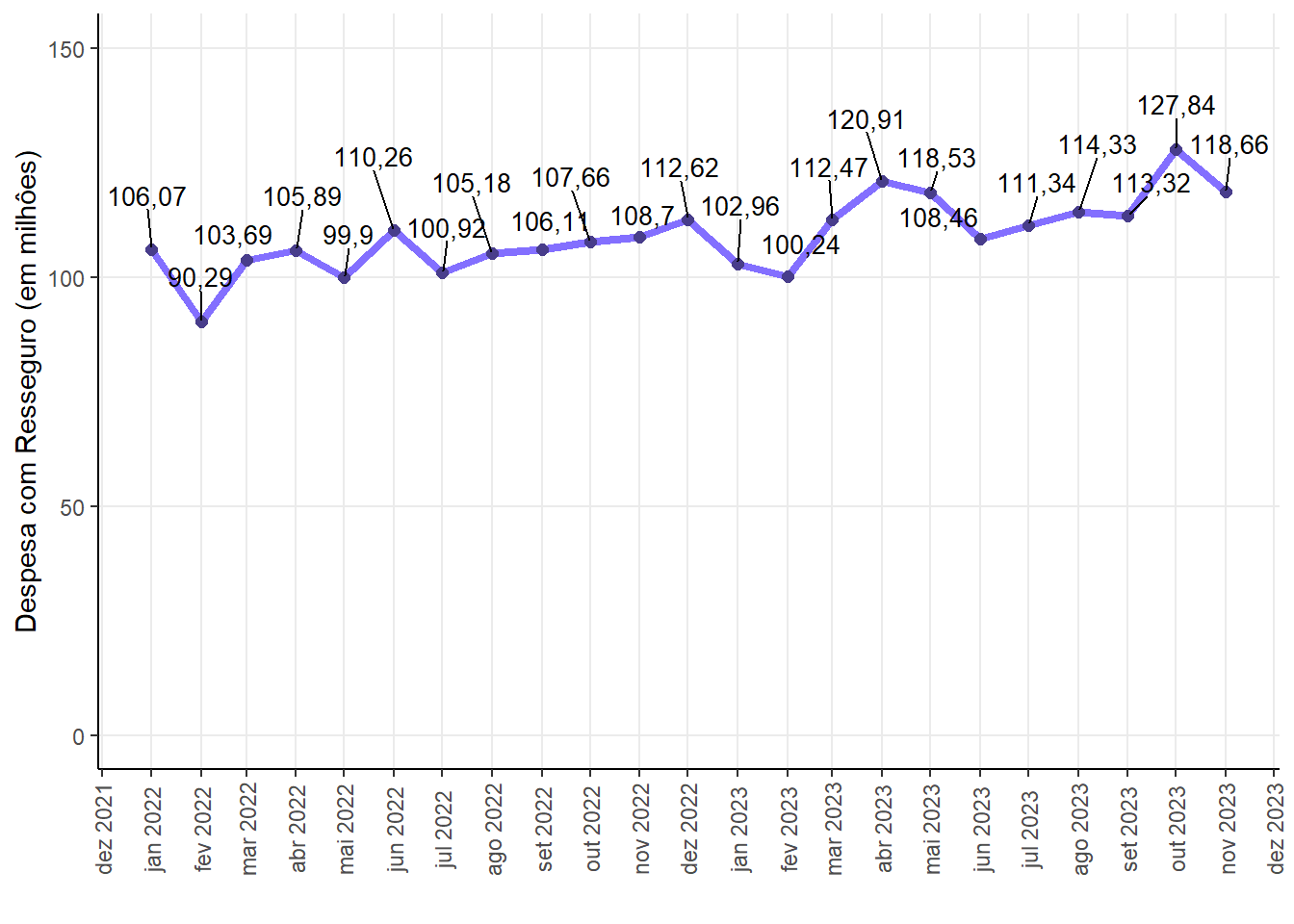

Historical series of the reinsurance expense for the sector 775 - Insured Guarantee - Public Sector

Reinsurance is a practice that allows insurers to transfer part of the risks they assume to other companies, called reinsurers. This is done to protect the assets and operational results of insurance companies, increase their retention capacity, offer protection against risks caused by catastrophes and stabilize the loss ratio.

Reinsurance expense refers to the total value of premiums allocated to reinsurers, in addition to their participation in all claim payments. In other words, it is the cost that the insurer has to transfer part of the risks it has assumed to the reinsurer. This amount is paid as a reinsurance premium by the insurer (or cedant) to the reinsurer.

Regarding reinsurance expenditure, the lowest expenditure on the 775 insurance sector was in February 2022. Furthermore, the highest expenditure was recorded in October 2023, with a value of 127,84 million.

Reinsurance Expense (in million)

|

||||

|---|---|---|---|---|

| Min. | Median | Mean | Max. | Std Dev |

| 90,29 | 108,46 | 108,97 | 127,84 | 8,1 |

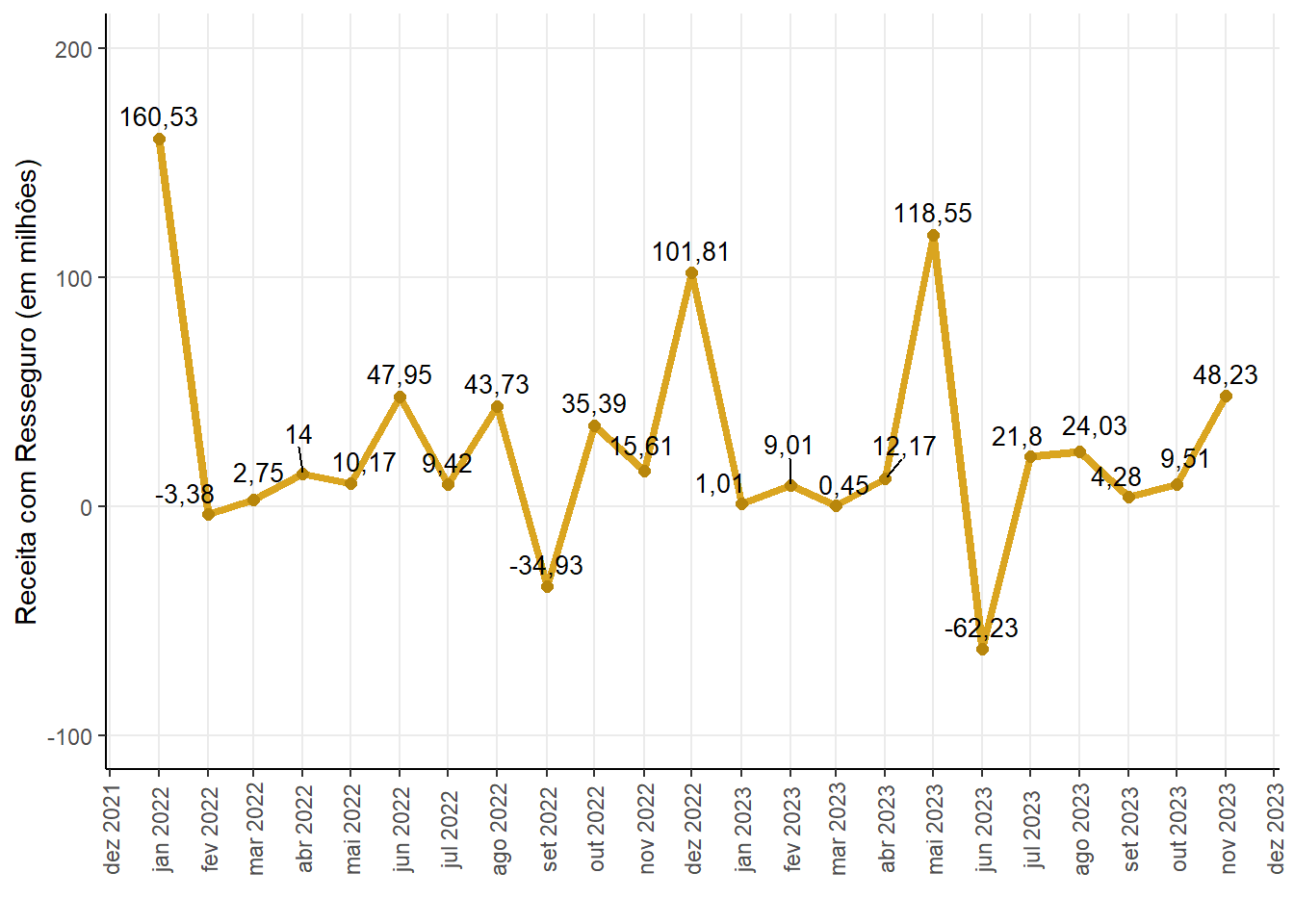

Historical series of the reinsurance income for the sector 775 - Insured Guarantee - Public Sector

Reinsurance income is the premium that the insurer (or cedant) receives from the reinsurer in exchange for transferring part of the risks that the insurer has assumed. This premium is paid by the reinsurer to the insurer and is considered income for the insurer.

Reinsurance Income (in million)

|

||||

|---|---|---|---|---|

| Min. | Median | Mean | Max. | Std Dev |

| -62,23 | 12,17 | 25,65 | 160,53 | 47,67 |

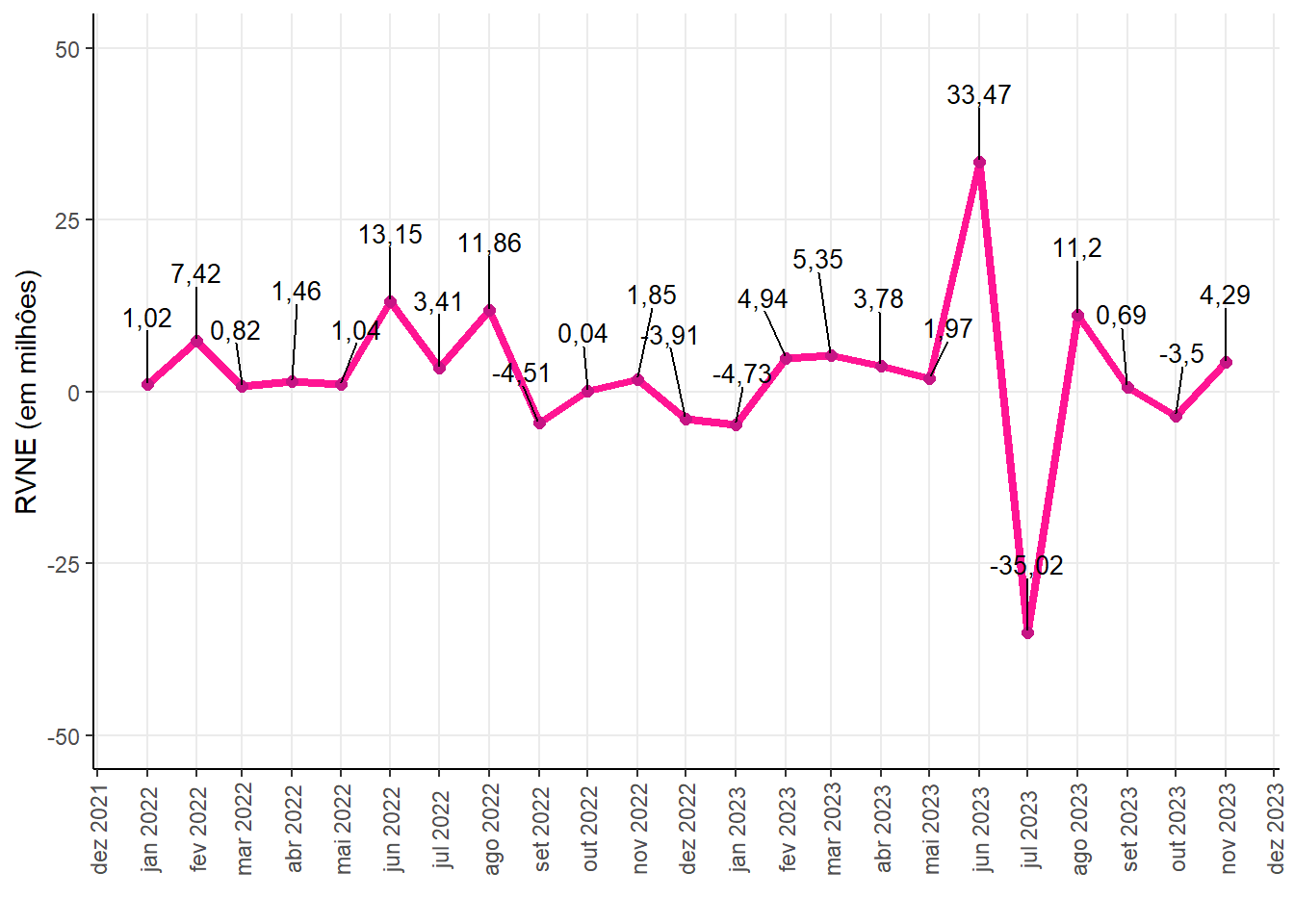

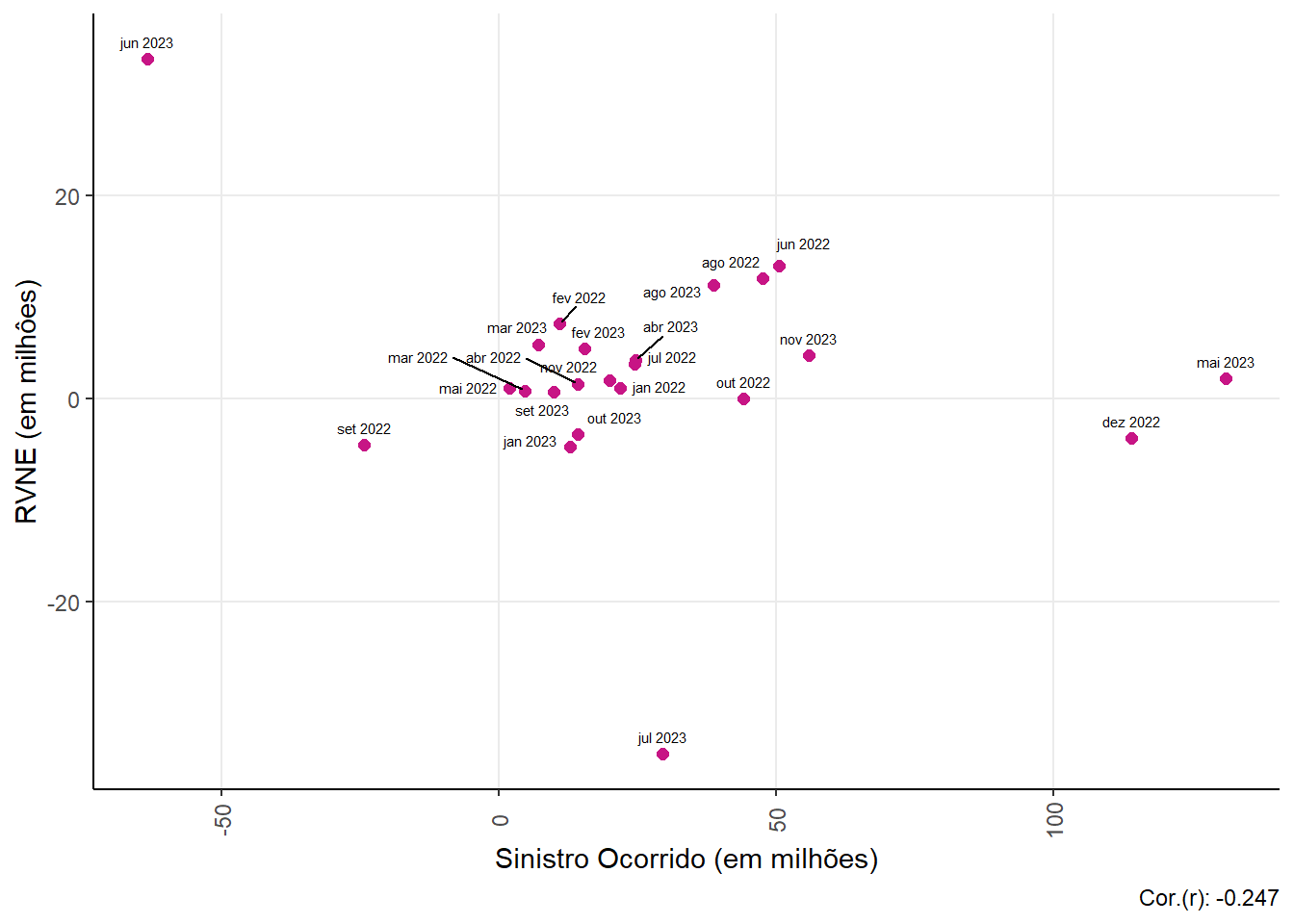

Historical series of the RVNE for the sector 775 - Insured Guarantee - Public Sector

Current Unissued Risks (RVNE) refers to a situation where the term of an insurance policy has begun, but the policy has not yet been issued.

The Provision for Unearned Premiums - Current and Unissued Risks (PPNG-RVNE) corresponds to an estimated portion of the Provision for Unearned Premiums (PPNG) relating to these risks.

It is important to highlight that the values referring to risks assumed, not in force and not issued are not part of the PPNG-RVNE. In other words, the PPNG-RVNE is specific to risks that are already in force, but whose policy has not yet been issued.

RVNE (in million)

|

||||

|---|---|---|---|---|

| Min. | Median | Mean | Max. | Std Dev |

| -35,02 | 1,85 | 2,44 | 33,47 | 11,45 |

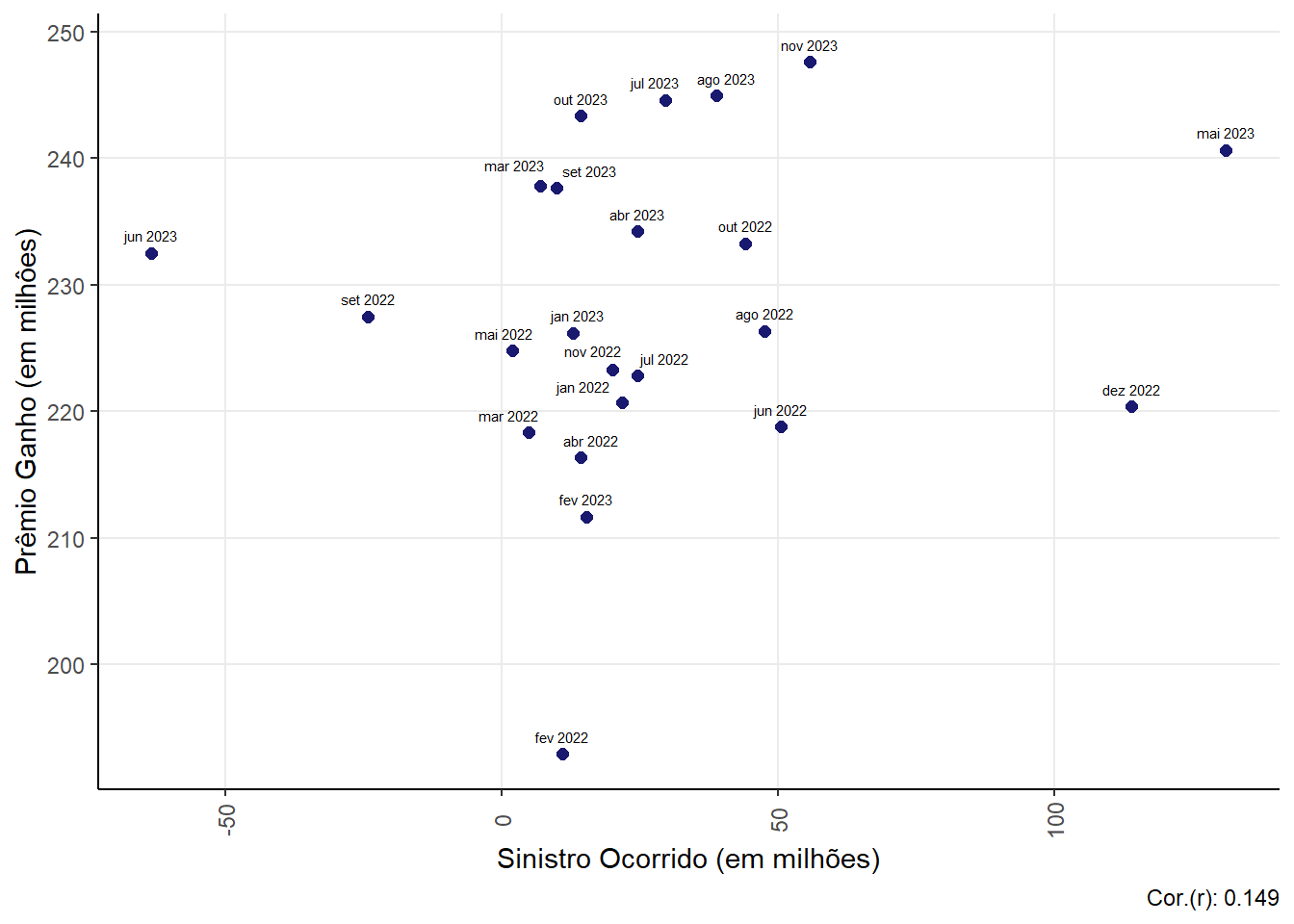

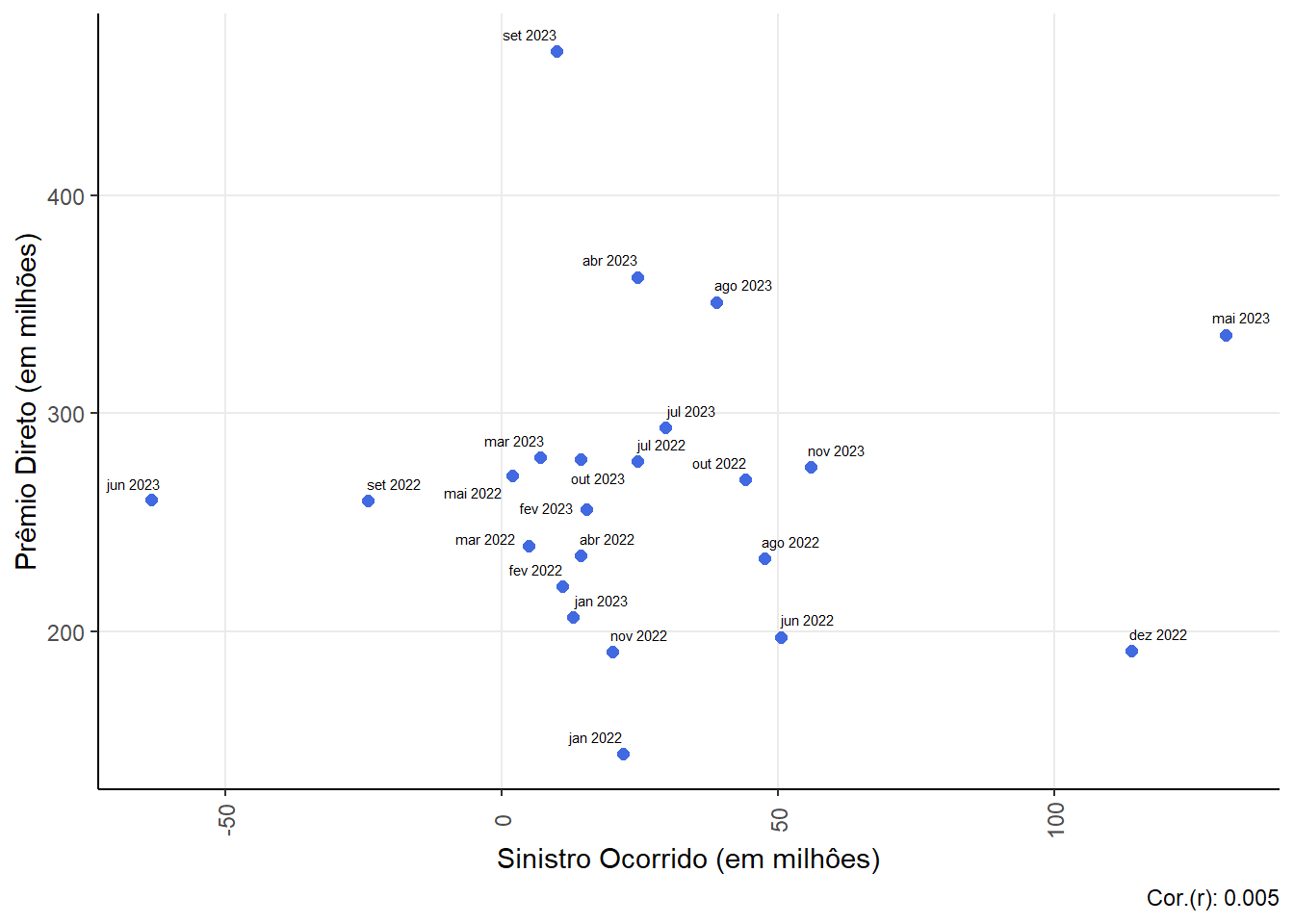

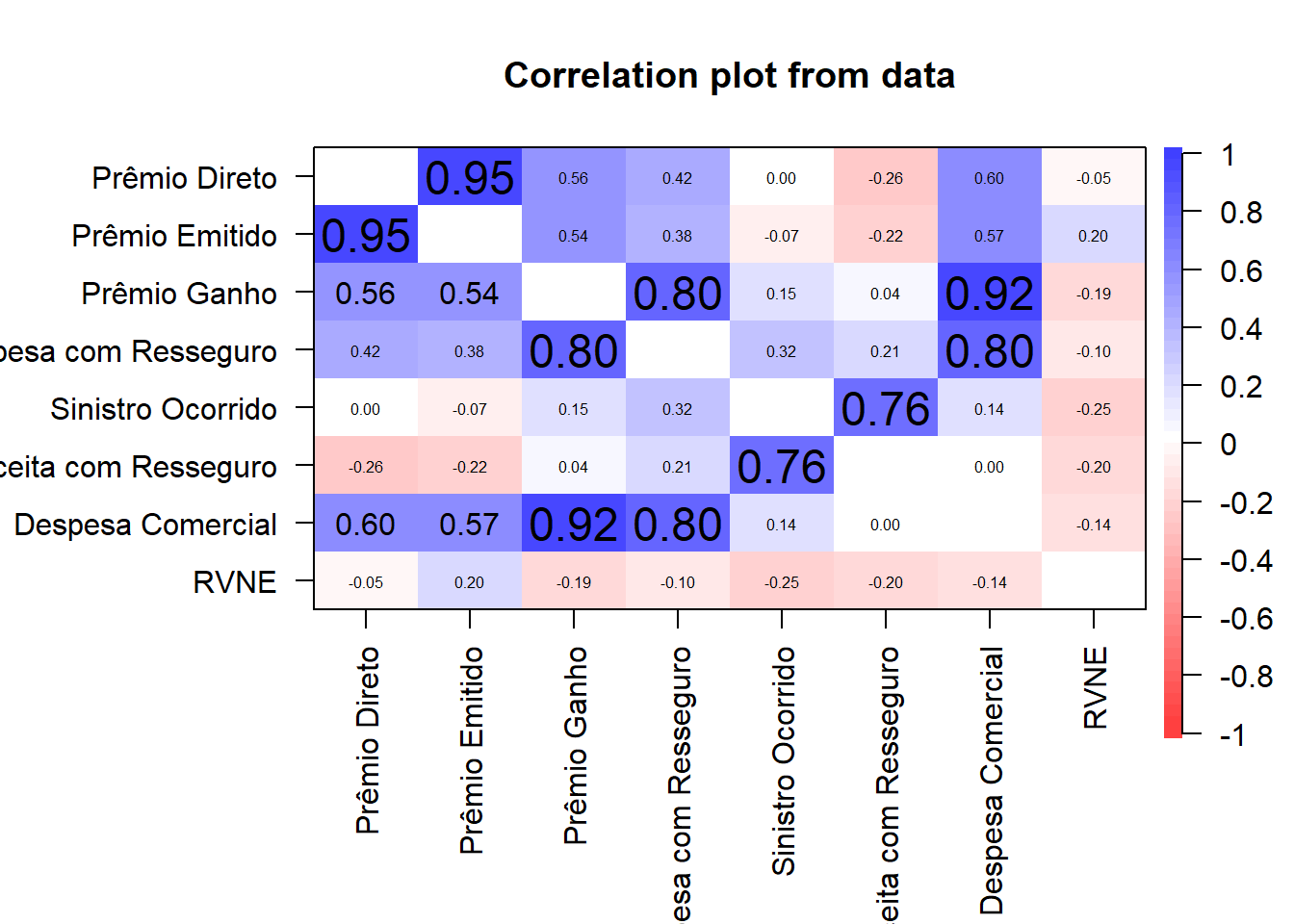

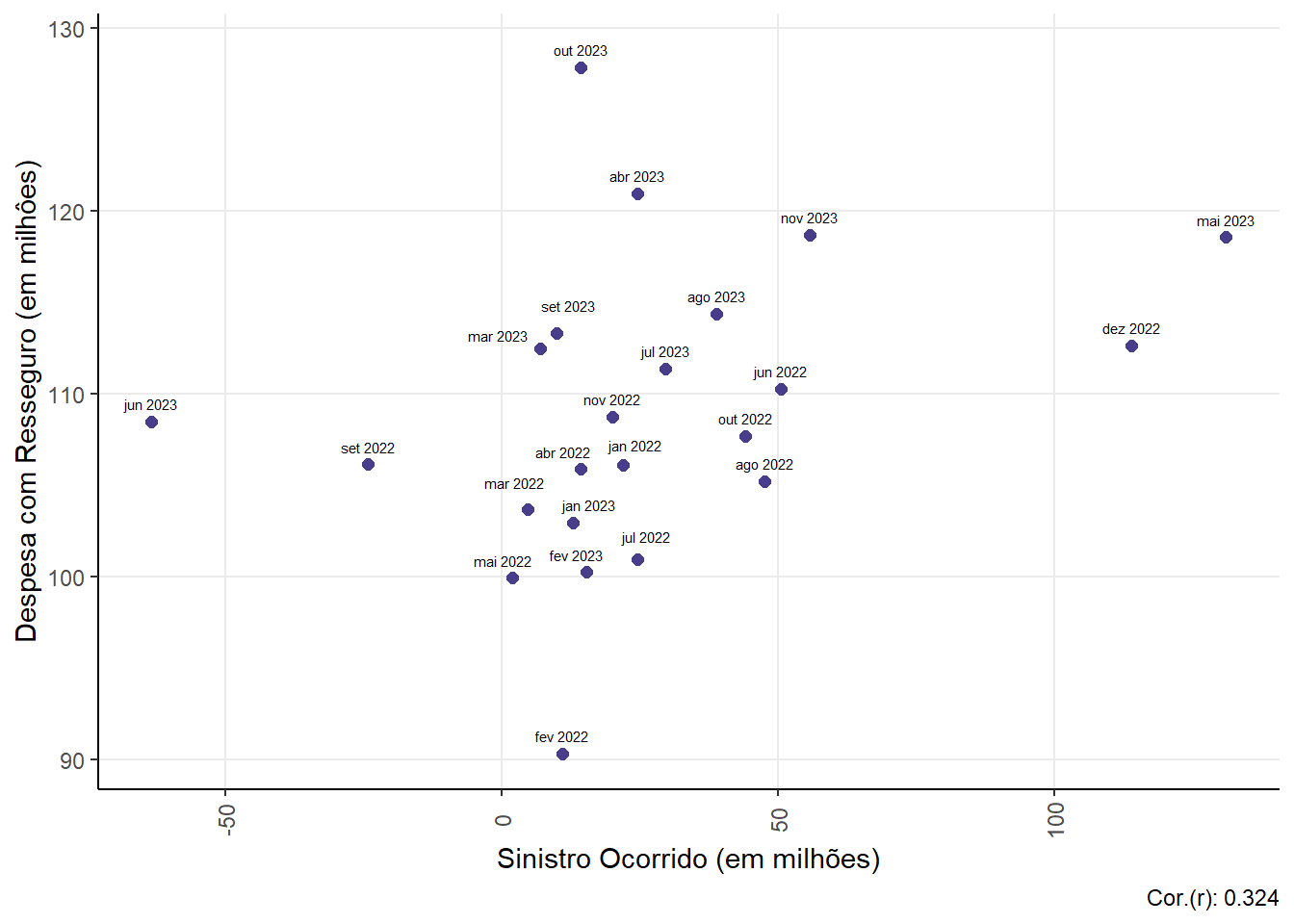

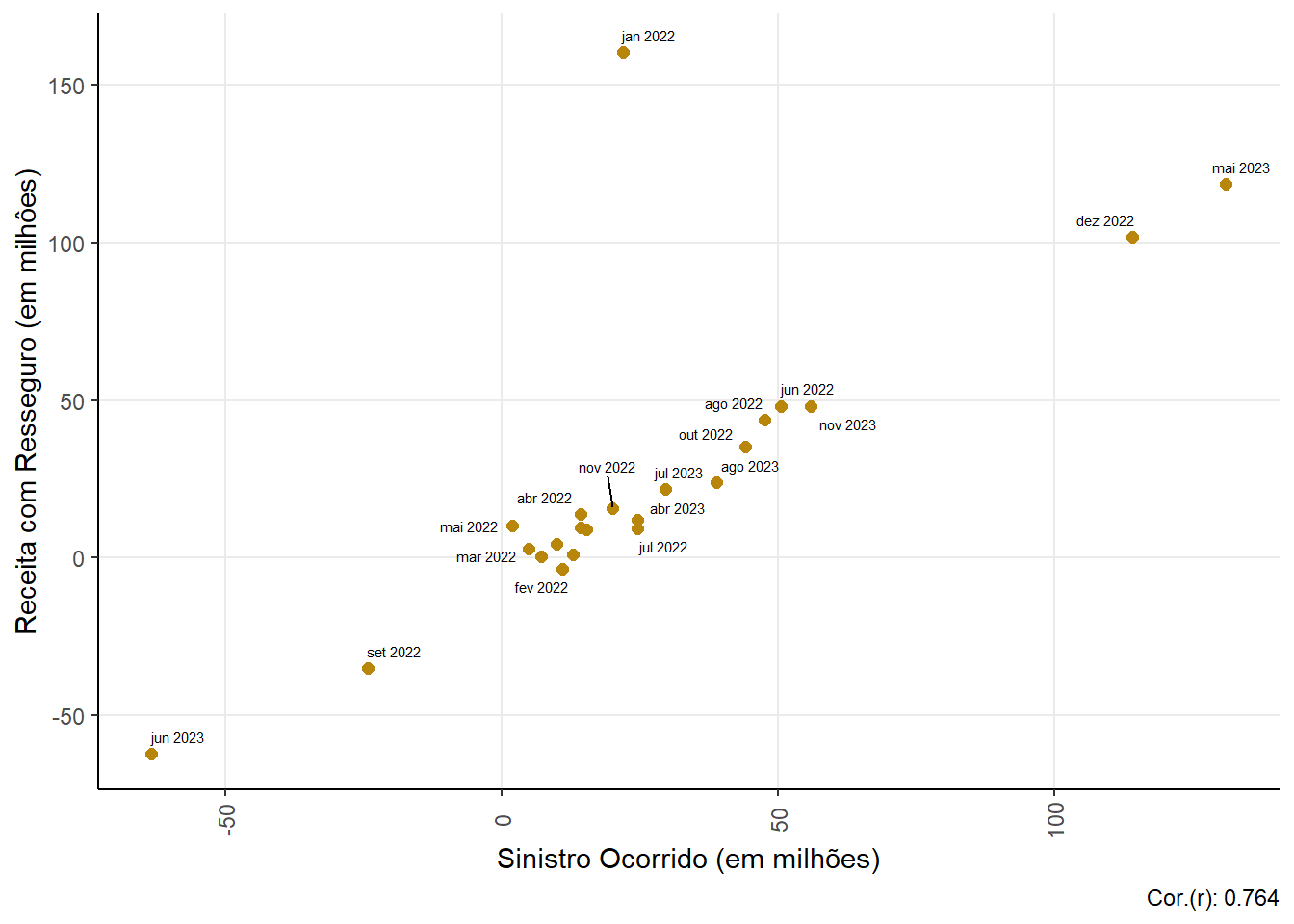

Relationship between variables

In this subtopic we can see the relationship between the variables through the scatterplot and correlation.

The correlation between two numerical vectors is a measure that indicates the degree of linear relationship between these two vectors. In other words, it tells us how much one variable changes in relation to another.

The formula to calculate the correlation between two vectors X and Y is:

\[r = \frac{\sum_{i=1}^{n} (x_i - \bar{x})(y_i - \bar{y})}{\sqrt{\sum_{i=1}^{n} (x_i - \bar{x})^2(y_i - \bar{y})^2}}\]

Where:

- \(n\) is the number of elements in the vectors

- \(x_i\) and \(y_i\) are the elements of vectors \(X\) and \(Y\), respectively

- \(\bar{x}\) and \(\bar{y}\) are the averages of the vectors \(X\) and \(Y\), respectively.

The value of \(r\) ranges from -1 to 1. If \(r\) is 1, there is a perfect positive correlation, which means that as one vector increases, the other also increases. If \(r\) is -1, there is a perfect negative correlation, meaning that as one vector increases, the other decreases. If \(r\) is 0, there is no correlation between the vectors.

Relationship between Claim (claim ocurred) and Reinsurance Expense

Relationship between Claim (claim ocurred) and Reinsurance Income

Relationship between Claim (claim ocurred) and RVNE

Conclusion

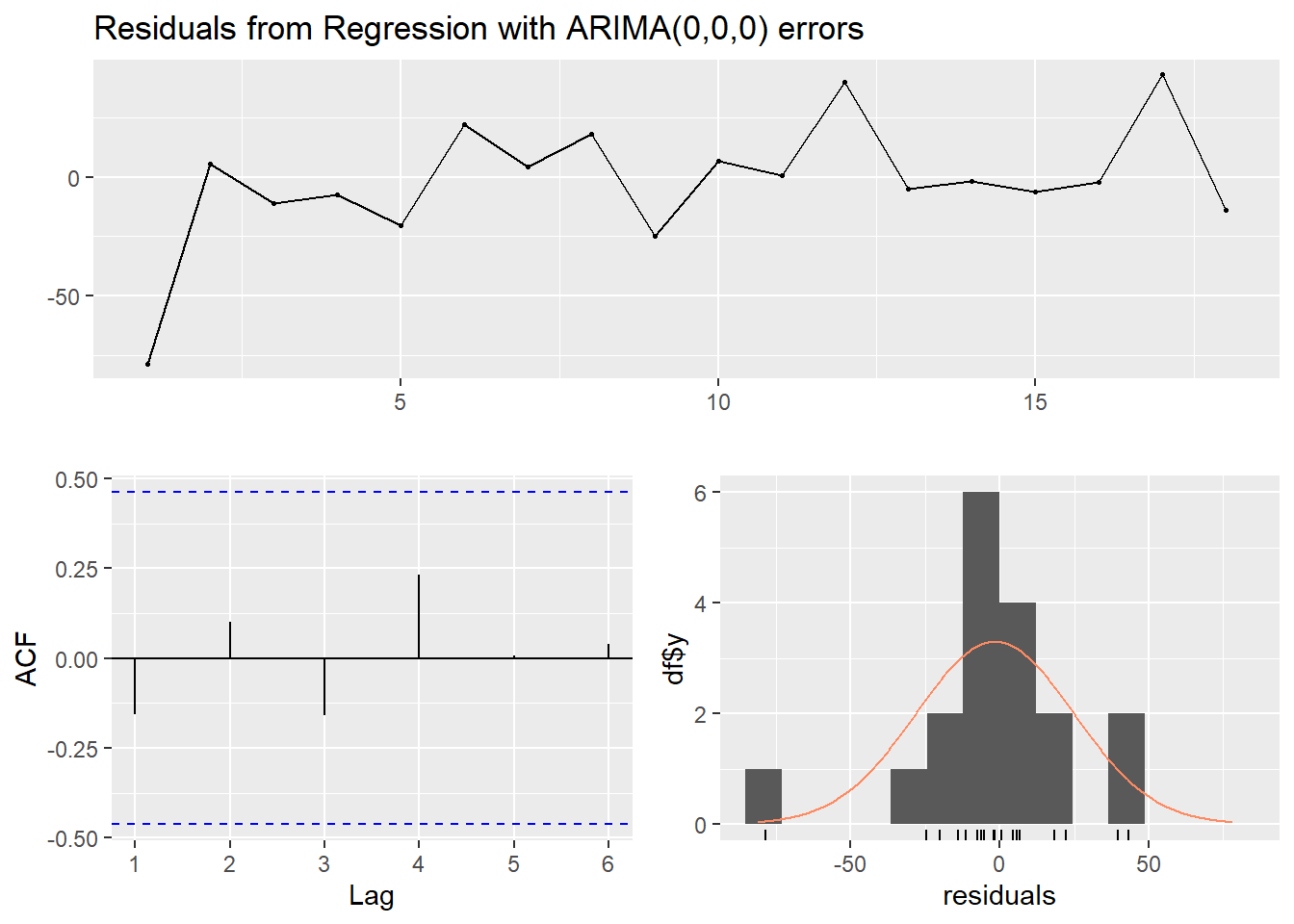

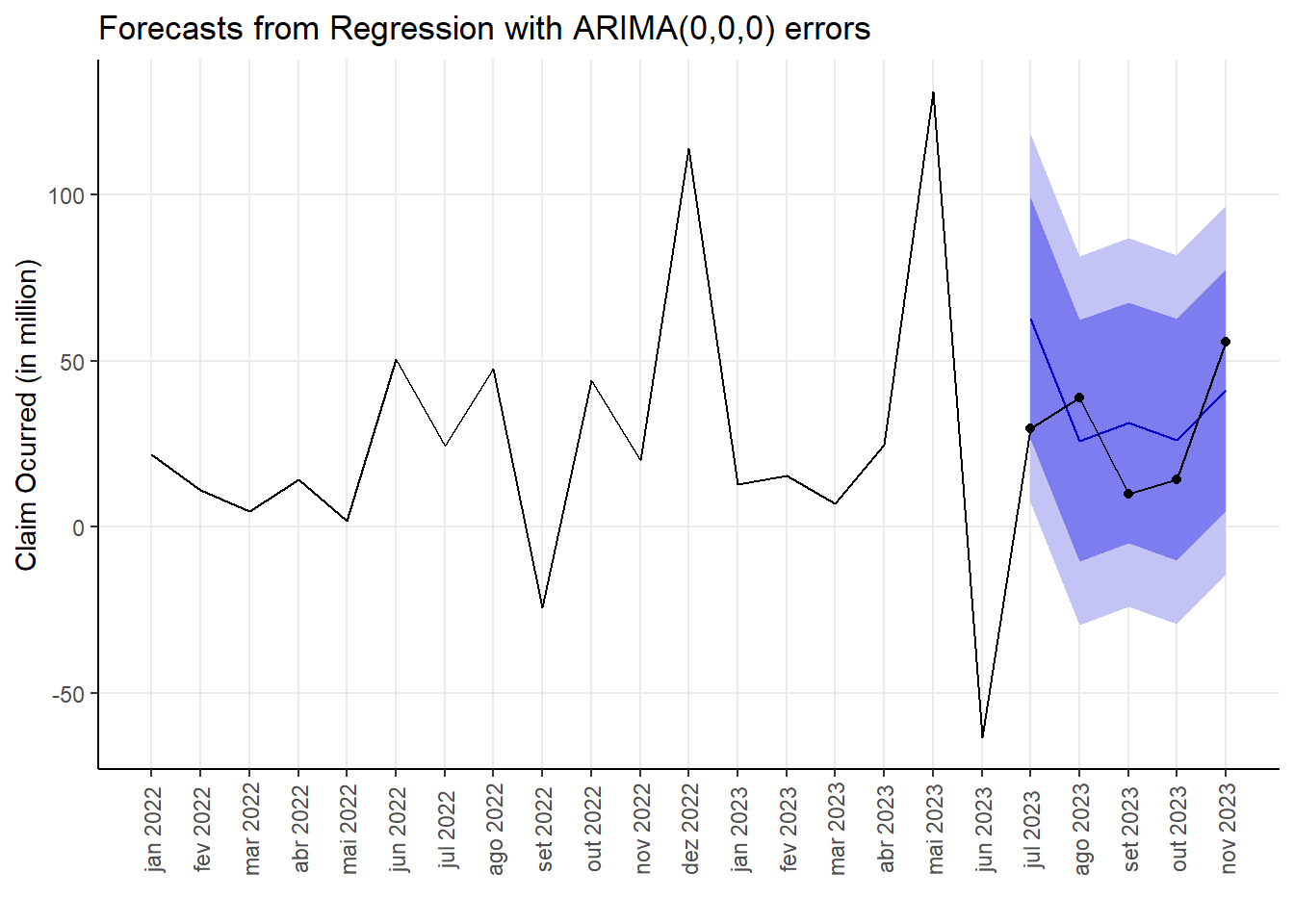

In the insurance market, the ARIMA model can be used to predict future trends and patterns. This can help the company prepare financially for these claims and set insurance premiums more accurately. Additionally, the ARIMA model can be used to forecast demand for different types of insurance, which can help insurance companies develop and market their products more effectively.

In the general financial market, the ARIMA model is often used to predict stock prices, exchange rates, interest rates and other financial indicators. These predictions can be extremely valuable for investors and traders as they can help them make more informed investment decisions. Additionally, financial institutions can use the ARIMA model to manage risk and volatility in their portfolios.

In summary, the ARIMA model is a powerful tool that can help companies better understand trends and patterns in their data, make more accurate predictions, and make more informed business decisions. However, like any statistical model, it is important to remember that ARIMA model predictions are based on assumptions and are subject to uncertainty. Therefore, they should be used as one of many tools in a well-informed decision-making approach.

We can mention, for example, our case carried out for the Public Guarantee sector (775) in Brazil, in which the model achieved good adjustments for some cases but was far from adequate for one situation. This distance may be due to the fact that we used little data or even the number of variables used. Maybe I’ll do another study on this soon, thank you very much for reading :).

References

Website:

1library.org: 1library.org. Retrieved from http://www.susep.gov.br/download/menumercado/orientacoes_seguros.pdf (Accessed: February 13, 2024).

Allianz: Allianz Brasil S.A. (2022). Condições Gerais 775 Seguro Residencial. Retrieved from https://www.allianz.com.br/seguros/seu-patrimonio/residencia.html (Accessed: February 13, 2024).

Azos: “Mercado de Seguros.” AZOS. Retrieved from https://www.azos.com.br/ (Accessed: February 13, 2024).

Nubank: Nubank (2023). Prêmio do Seguro: O Que Significa Esse Termo? Retrieved from https://blog.nubank.com.br/vale-vida-nubank/ (Accessed: February 13, 2024).

Doutor Finanças: “Seguros: Teve um Sinistro? Conheça os Seus Direitos e Obrigações.” Doutor Finanças. Retrieved from https://www.doutorfinancas.pt/seguros/seguro-de-acidentes-pessoais-o-que-e-e-como-pode-proteger-nos/ (Accessed: February 13, 2024).

Economia e Negócios: “Por Que os Prêmios Ganhos São Importantes?” Economia e Negócios. Retrieved from https://www.jornaldenegocios.pt/negocios-iniciativas/premio-nacional-de-inovacao/detalhe/pme-desempenham-papel-vital-na-era-da-inovacao-e-dados (Accessed: February 13, 2024).

Forecasting: Principles and Practice. Retrieved from https://otexts.com/fpp2/arima-r.html (Accessed: February 13, 2024).

InfoMoney: “Entenda Como Funciona e Para Que Serve o Resseguro.” InfoMoney. Retrieved from https://www.infomoney.com.br/tudo-sobre/seguros/ (Accessed: February 13, 2024).

Investopedia: Investopedia (2022). Autoregressive Integrated Moving Average (ARIMA). Retrieved from https://www.investopedia.com/terms/a/autoregressive-integrated-moving-average-arima.asp (Accessed: February 13, 2024).

Mutuus: “Resseguro: Entenda Como Funciona.” Mutuus. Retrieved from https://www.mutuus.net/ (Accessed: February 13, 2024).

Mutuus: “Seguros: O Que São e Quais Tipos Existem?” Mutuus. Retrieved from https://www.mutuus.net/ (Accessed: February 13, 2024).

Government Website:

- Superintendência de Seguros Privados (SUSEP) (2023). Prêmios e Sinistros. Retrieved from https://www.gov.br/susep/pt-br (Accessed: February 13, 2024).

Academic Journal:

Chambers, J. M. (1992) Linear models. Chapter 4 of Statistical Models in S eds J. M. Chambers and T. J. Hastie, Wadsworth & Brooks/Cole.

Hyndman, R. J., & Khandakar, Y. (2008). Automatic time series forecasting: The forecast package for R. Journal of Statistical Software, 26(3), 2-7.

Venables, W. N. and Ripley, B. D. (2002) Modern Applied Statistics with S. New York: Springer (4th ed).

Wang, X., Smith, K. A., & Hyndman, R. J. (2006). Characteristic-based clustering for time series data. Data Mining and Knowledge Discovery, 13(3), 335-364.

Wilkinson, G. N. and Rogers, C. E. (1973). Symbolic descriptions of factorial models for analysis of variance. Applied Statistics, 22, 392–399. doi:10.2307/2346786.